What Is The Standard Home Office Deduction For 2021. The decline in value of home. Web 10 rows standard deduction of $5 per square foot of home used for business (maximum 300 square feet). You must have spent the money yourself and weren't reimbursed it must be directly related to earning your income. Web you can claim the fixed rate of 52 cents for each hour you worked from home. Web september 1, 2021 the home office deduction allows certain taxpayers to deduct expenses attributable to the business use of their homes.

Web march 10, 2023 in business income 0 the home office deduction calculator is an easy way to compute the deduction you can claim for carrying your business or. Web the revised fixed rate of 67 cents per work hour covers energy expenses (electricity and gas), phone usage (mobile and home), internet, stationery, and computer consumables. The rate includes the additional running expenses you incur for: What Is The Standard Home Office Deduction For 2021 Web as an employee, to claim a deduction for working from home, all the following must apply: Web 10 rows standard deduction of $5 per square foot of home used for business (maximum 300 square feet). You must have spent the money the expense must directly relate to earning your income.

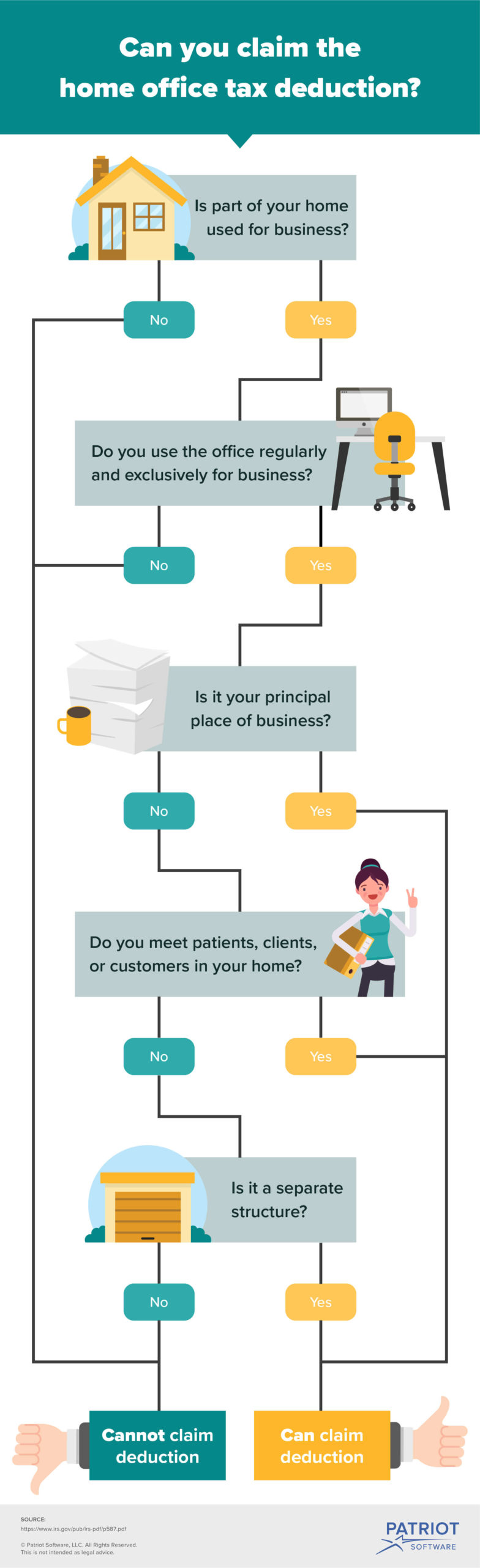

Home Office Tax Deduction What Is it, and How Can it Help You?

Web deductions for a home office are based on the percentage of your home devoted to business use multiplied by expenses to maintain the home. Web the revised fixed rate of 67 cents per work hour covers energy expenses (electricity and gas), phone usage (mobile and home), internet, stationery, and computer consumables. The decline in value of home. The rate includes the additional running expenses you incur for: Web as an employee, to claim a deduction for working from home, all the following must apply: Web you can claim the fixed rate of 52 cents for each hour you worked from home. Web te whakamahi i tō kāinga mō tō pakihi home office expenses if you’re a business owner and use part of your family home for work, you can make a claim for this as a business. What Is The Standard Home Office Deduction For 2021.